📊 Brief Introduction into how I trade the Nasdaq Futures

💬 Short Introduction:

When I started trading, I thought the key was finding the perfect setup. But over time, I realized the real edge came from structure, sizing, and discipline. I trade Nasdaq futures (NQ) because it offers the volatility to make real money daily — without needing to trade all day or catch the absolute top or bottom.

After trading tech stocks for years, it made sense to stay close to what I already knew — the Nasdaq. But futures gave me something stocks didn’t: leverage, speed, and a clean centralized order flow. It made reading the market way more straightforward. No hidden orders from 13 exchanges. Just one place. One feed. That’s all I needed.

🧠 My Mindset: Art, Rules, and Self-Control

I believe discretionary trading is an art rather than a science — but it needs to be mechanical.

Yes, setups and patterns matter. But it’s deeper than that. Trading well means trusting yourself, knowing when not to trade, and having the self-awareness to size down when the market isn't in your favor. That’s not something a chart pattern can tell you. That comes from experience and control.

My goal with trading isn't to get rich quick. It’s freedom. I don’t want to answer to anyone. I don’t want to be income capped. I want to earn based on performance — and I want the time to actually enjoy what I earn. Trading gives me that.

📊 My Strategy, In a Sentence

I trade basic support and resistance — but I do it with structure, timing, and intent. Every zone I trade is pre-planned. I look for areas where the market has clearly bounced or rejected in the past. These are the levels that matter. When price comes back to these zones, I’m ready. The stop is defined. The target is defined. My job at that point is simple: execute.

I don't micromanage, and I don’t move stops or targets. The decision was made before price even got there. Once the plan is set, the emotions are removed — and that’s how I avoid self-sabotage.

🔍 Pre-Market Routine: What I Do Before I Touch the Trigger

Every morning starts with context. I look at the 1-hour and 2-hour charts to understand where we are. Are we making higher lows? Are we breaking down? Are we stuck in a balance zone?

Then I zoom in to the 10- and 15-minute charts to mark key support/resistance levels. I skip the first 30 minutes of the market — always. That’s where most traders get chopped up. I let the market show its hand first.

If it’s a big opening drive, I wait for a retest. If we’re balanced, I plan to long the bottom or short the top. The setup either forms, or I sit.

🖥 Timeframes I Use

- 1-min: for execution

- 10-min / 15-min: for intraday structure

- 1-hour / 2-hour: for the bigger picture context

💥 The Setups I Focus On

Most of my trades are breakout retests, reversals, and continuation plays — all based on higher time frame zones. I’m never taking a trade because something “looks good.” If I’m not in before a breakout, I’ll wait for the retest. Simple as that.

A breakout is not a trade entry. A breakout is often an exit.

I use the DOM and Delta Footprint for confirmation, not the decision. I want to see absorption at key levels:

- At support: Buyers absorbing sells at the bid, lower wicks are your best friend.

- At resistance: Sellers absorbing at the ask, price rejects. Upper wicks here are your best friend.

📊 Risk Management: The Real Secret

My daily loss limit (DLL) is 100 NQ points at full size. But I rarely get there. Each trade risks about 15–20 points. If a setup needs a tighter stop (like 10 points), I size up. If it needs a bigger stop (like 40), I size down. Risk stays static — that’s how you avoid blowing up.

DLL isn’t a target. It’s a fire alarm. I usually walk away after losing half of it, or if things feel off. That’s how I protect my mental capital, not just financial.

🗒️ Trade Reviews & Journaling

I log every trade in Discord — before, during, and after. I write what I’m thinking, the setup, the stop, the target, and then review it afterward to classify the setup. I care more about following my plan than the outcome itself.

I have found that writing my thoughts and plans out has helped me with overtrading and becoming more clear. When I write my trade ideas out, I have no choice but to wait for them, otherwise what am I doing?

It helps consolidate my thoughts into actionable trade plans and makes it easier to review after the trading day has ended.

❌ Setups I Avoid

- Huge gap-up or gap-down days where I’m not positioned

- Predicting breakouts without confirmation

- Trading chop with no structure

⚠️ Common S/R Mistakes New Traders Make

- Treating support/resistance like a single line — it’s always a zone

- Buying the first touch without waiting for reaction

- Placing stops at precise & direct pivots instead of "waiting" for candle close

- Predicting breakouts instead of reacting

📚 My Method in 3 Rules

- Plan ahead: Entry, stop, and target must be defined

- React, don’t predict: Let the market prove it

- Always use the bigger time frame to build zones

🎯 Real Trade Example from Today:

🧠 1. Entry Planning & Idea Generation

I shared this in real-time: I was watching the 21,400–415 zone for a Long.

Since it moved without me, I am now looking to trade the Breakout Retest and Long 440-450, as planned below.

Planned early in Discord — watching both 415 and 440 as key levels.

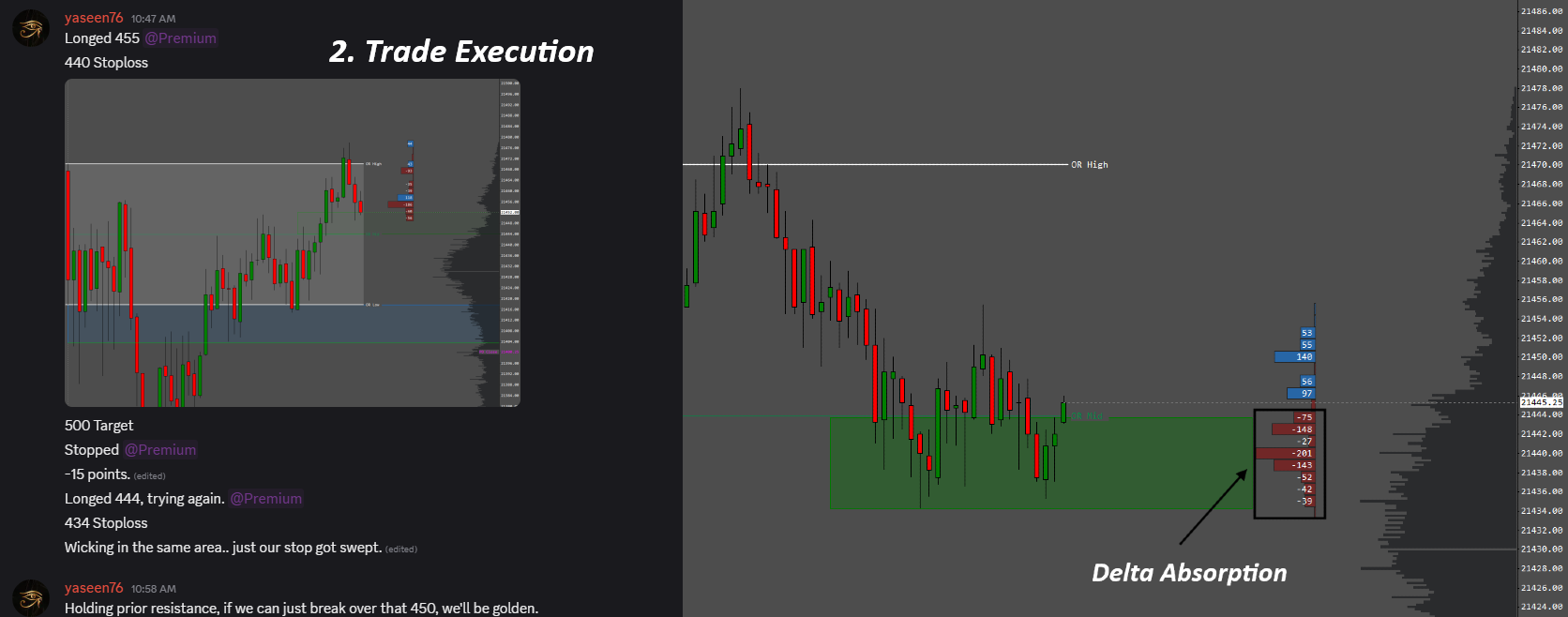

📊 2. Trade Idea & Context

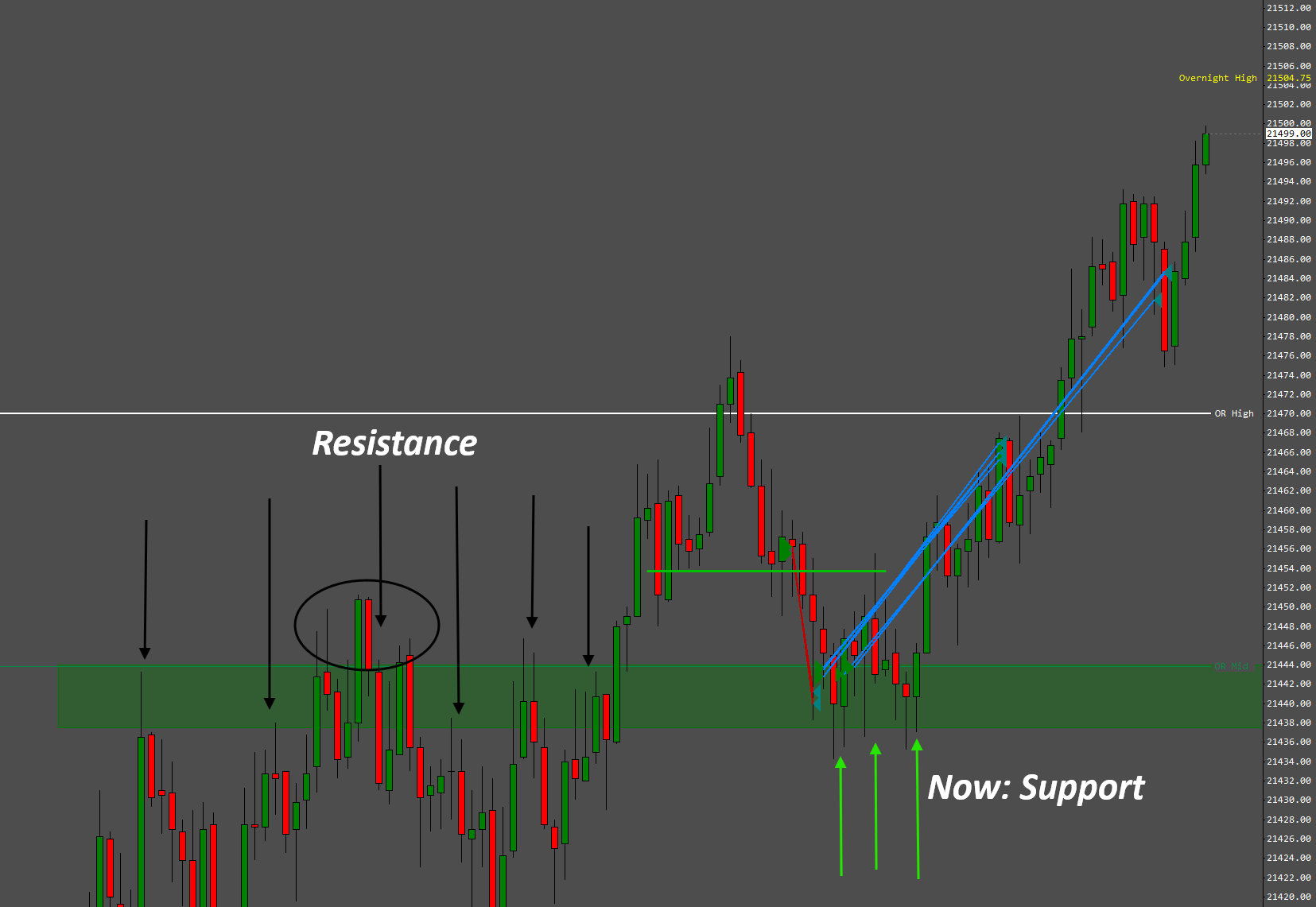

Here’s the actual chart and thoughts. Price retesting the previous resistance at 435-445 (Green Box).

Previous resistance becomes support — the core of the setup.

Additional Confirmation: Delta Absorption as highlighted. No follow-through on selling pressure — I added more size. Classic confirmation to re-enter stronger.

✅ 3. Final Chart Execution

First long at 455, stopped at 440. Re-entered at 444 with 434 stop. Tight risk, same thesis.

Half partial at 2.1R and final target at 4R. $4K Risk, $12.5K Reward -- 3.1x Risk Reward Ratio

Structure + sizing + confirmation = Clean win.

↺ Key Lessons From This Trade

- Trust your zone — one stopout doesn’t invalidate the area.

- Concentrate size when conviction is high and risk is small.

- No random entry, no random exit. Patience & Trust in your system.

- Plan → React → Execute — nothing random.